Guns, Butter and Fort Knox

“In the Bank, one gets in the habit of being over-discreet. Now then, this business of gold. I take it is not a matter you’ve thought about a great deal.” Said Colonel Smithers. “I know it when I see it.”, replied Mr. Bond

I wasn’t planning on this being my Substack launch but felt a calling as one who has closely followed gold for 30 years to weigh in on the Fort Knox issue. Firstly, great thanks to

, , , , , , , , , , and all others who have helped me during my Substack journey.This is not another detailed history of Fort Knox (

has done the best I’ve seen). It is more of a testimonial from my early days as a young gold analyst in the mid-1990s as to why there may be less gold in Fort Knox.I ended at Oppenheimer as Kidder Peabody refugee in 1995 working for a larger than life nonferrous/ferrous metals analyst, Bob Hageman. When I say larger than life, what I mean is it wasn’t uncommon for him to field calls from Alan (Maestro), Julian R, George S, Peter L, Jon B…those kinds of titans. Oppenheimer’s legendary strategist Michael Metz was a huge gold bug and wanted the gold stocks to be covered. My boss had no interest, but thought I was up to it (the best compliment of my career). What was I to say at age 26 to being a Sr Equity Analyst, especially with that backing.

As a lover of history, I dove right in but decided to stay in the modern financial era. I was as shocked as I was fascinated by what I learned, especially FDR’s Executive Order 6102 in 1933 by which the US basically confiscated its citizens’ gold. Failure to comply was punishable by fines up to $10,000 ($243K in today’s dollars) and up to ten years in prison. This wasn’t a full confiscation because the Government gave paper “worth” $20.67/oz, then promptly revalued the gold on their own books at $35/oz. Private ownership of gold bullion was illegal until 1974 - just think about that. Fort Knox was built basically to house this gold. Another very interesting fact is that in 1934 FDR established the Exchange Stabilization Fund (ESF) to basically “manage” the price of gold relative to the dollar, among other things. The ESF is still active today and at the end of 2023 total assets were $213B with a net position of $39B. So, this creature of the Treasury Department is basically the biggest hedge fund in the world.

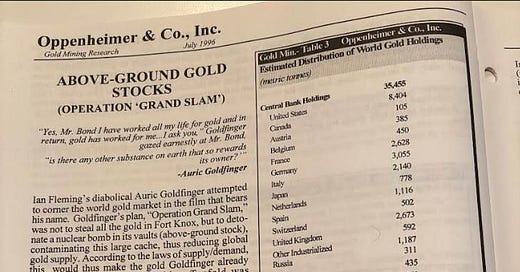

Being a huge fan of Ian Fleming I decided to reread Goldfinger and make it thematic to my initiation piece (see and read below). During my research process I started to understand gold as an asset more than a commodity. This was very unusual at the time because the overwhelming consensus was that gold was just a commodity purely dictated by Indian jewelry demand and Central Banks dumping gold at any given moment. I characterized sentiment at the time as gold finally being jettisoned to ash heap of history for good!

Although I was proud of my launch, I expected to be received by crickets, after all gold had been in a multidecadal bear market, the $ was almighty and Maestro was in charge. To my shock, I started to get calls from senior PM/CIOs from some of the largest funds in the world. Not to the caliber of my boss, but these were very big players with decades of experience, including the Nifty Fifty, the inflation cycles of the 1970s, Volker, Black Monday, etc.…. Importantly, they all considered gold an asset and wanted to speak with me because I was one few people writing about it as an asset.

Guns, Butter and Fort Knox

A common theme started to emerge in all my conversations with these clients that there definitely is not as much gold, if any gold, in Fort Knox as the Government claims. The reason, or theory was mostly was that during the 1960s LBJ’s policy that he could both fund Vietnam spending and massive social spending simultaneously without raising taxes while not increasing deficits was highly unlikely, even laughable. Thus, the “Guns and Butter” mock was born. The thought was that the only way to keep his promises was for LBJ to secretly sell gold from Fort Knox. Clear evidence they said was that the Fort Knox “audits” were just for show rather than any kind of real accounting of the physical bullion.

Another reason was that during the 1960s France’s de Gaulle initiated the secret operation “Vide-Gousset” (pocket emptying) which repatriated as much as 3,600 tons of bullion from the US and UK. Great piece here on the subject

For whichever reason many matter-of-factly but firmly believed that Fort Knox’s gold holdings were greatly overstated. Again, they weren’t crackpots but rather lived and managed money during those times. So, all this talking about how much gold is or is not in Fort Knox is nothing new. The big difference this time is that Trump and Musk may actually do a proper audit to confirm if there really is 4,583 tungsten, sorry tons of gold in Fort Knox.

Operation “Grand Slam”

Goldfinger figured that if he took Fort Knox out of the equation his gold holding’s value would increase tenfold. I’ve wondered ever since I first read the book as a kid why he called his plan “Operation Grand Slam” instead of “Operation Ten Bagger” Anyway, my conclusions are quite simple. I remain steadfastly bullish. There are two possible outcomes:

Firstly, there really isn’t as much gold in Fort Knox as stated, which should further call into question the credibility of the financial system. As the great James Grant said in the late 1990s “The price of gold is the reciprocal of Central Banker’s reputations.” Would the US buy to replenish the “missing” gold as many think they are currently doing? I don’t think that this is what is going on presently, but the administration would likely clarify.

Secondly, the gold is there, which would likely cause a sharp correction. Then there should be the realization that Governments, led by the US will want to dramatically revalue their gold. I know, at $42.22/oz that doesn’t mean much, but several CBs in Europe whom already mark-to-market have been floating the idea of marking higher than market. I expect Central Bankers to continue to be the biggest buyers of gold. Just think, OPEC hasn’t even started buying…

The Macro Strategy Partnership LLP

“Mr. Bond, the word ‘pain’ comes from the Latin poena meaning ‘penalty’ – that which must be paid” Auric Goldfinger

What to expect from TMacro06 – My first love is Metals and Mining, but I will write about all things Natural Resources, both commodities and equities. Also expect to write about macro, markets and any other things I find worthwhile. As some of you know already I certainly am not shy about weighing in the chats and replies.

Thank you!

TMacro06 is not a registered investment advisor, and comments are for informational use only. Any mention of a particular security, index, derivative, or other instrument is NOT a recommendation to buy, sell, or hold that security, index, derivative, or any other instrument. TMacro06 makes no representations as to the accuracy of data or any attributions.

Hi TMacro!

Great write-up up!

I'm happy to be here to read your thoughts....haha.

LBJ was a first rate scoundrel. Kennedy was killed in Dallas. Another strange coincidence.

there's a third possibilty to consider: the gold is there now, and the administration realizes they can make use of it and blame someone else later.